A response to David Rosenthal’s crypto critique

An early enginer at Nvidia published an essay recently, and it’s been doing the rounds on Twitter. It is presented and shared as an insightful and well referenced technical criticism of crypto. It is not. It is a meandering list of unsupported conjecture and opinion wrapped in the guise of rigorous analysis. It is the deeply and fundamentally flawed and wrongheaded aggregation of one engineer's wholy unproven instictual assessments of a complicated space. It relies on omissions and mischaracterisations that are more FUD than revelation.

I'm engaging in good faith because I agree that crypto is filled with charlatans that folks ought to be sceptical of, as well as genuine potential for innovation in the domains humanity most urgently needs it (and I don’t mean finance).

I want to find technologies that thwart crypto grifters while unlocking important innovations, and therefore I want to demolish weakly-argued FUD so we can focus our attention on the very large and real problems that do exist in crypto.

So, in order, we'll review the essay's fatal flaws, areas of agreement, and a slide-by-slide dissection to rigorously challenge all the unproven assertions. The first two sections stand on their own, but the slide-by-slide is most useful if you've read Rosenthal's original essay.

Fatal, recurring flaws in the talk / essay

These are themes that Rosenthal develops and returns to throughout the essay, and whose flaws of logic ultimately doom the essay.

- The assumed Energy Morality Police. Rosenthal believes that there exists a universal morality governing the use or waste of energy. Banning Bitcoin because its carbon emissions come in service of a an application one deems wasteful is as hollow a moral argument as "pornography or any art or video game I find morally corrupt should be banned, lest we emit carbon for anti-social purposes." Anyway, he doesn’t explain what principles his moral authority is derived from, only that he happens to judge Bitcoin to be a particularly malign use of energy.

- Rosenthal misunderstands (or misrepresents) the purpose of base-layer transaction capacity. He considers Bitcoin's low transaction volume (compared to, say, Visa) to be a damning flaw, but doesn't explain why. Gold is a scarce, socially-priced store of value that is ridiculously inefficient as a currency, and moves as slowly and insecurely as literal rocks. The number of transactions per second any particular blockchain can achieve is as meaningful as the number of gold-bar denominated transactions achievable per second. We didn't get better at moving gold rocks around, we invented a second-software-layer scaling solution: Gold ETFs - the gold stays in one place, the transactions happen at "Layer 2" (the ETF). Crypto Layer 2’s are to Bitcoin what Gold ETFs are to shiny rocks. It’s curious that Rosenthal doesn’t address Layer 2’s at all, whilst attacking Bitcoin's transaction capaxity

- Killing Bitcoin (and/or all Proof of Work crypto) won’t slow global heating at all: humanity’s appetite for energy has grown steadily and exponentially since the Industrial Revolution. The COP26 summit showed humanity is not going to reduce our emissions at anywhere near a rate that will save our planet from overheating. The only chance Earth has is developing zero-carbon energy sources that can be used to sequester atmospheric carbon. And if reducing emissions is the important bit: isn't our effort best spent on the biggest emitters?

There are some excellent points in the essay, too:

- There are real risks to the centralisation of “decentralised” systems, and major blockchains exhibit levels of centralization that should evoke concern. This is a problem worthy of investment.

- There are plenty of bad actors in crypto, and if the good actors don’t run the bad actors out of town, we deserve to be regulated out of existence. Celcius and Tether both seem unreasonably opaque, and the tacit endorsement of this opacity isn’t helping build trust in crypto.

- Rosenthal is strongly negative on El Salvador's adoption of Bitcoin. His criticisms here are more about President Bukele than anything unique to El Salvador, but unquestioned praise of Bukele (ot any other pro-crypto lawmaker, regardless their other positions) from the crypto crowd is - at the least - a PR own-goal-in-waiting.

- Blockchain immutability does create real risks for end-users, that are not present in the way thing are done today. It’s a shame he doesn’t discuss how risk can be modeled and insured against.

On to the play-by-play...

Slide 2: Externalities

Rosenthal considers Bitcoin (and Proof of Work, more broadly) a malign waste of energy, particularly harmful because of resulting the carbon emissions.

Here’s an identically vacuous value judgement:

All the energy used to render violent games, or stream and view pornography is a moral waste, so these applications should be banned.

The world is a big place, and if one wants to talk about externalities, how about the externalities that we Americans offload to the rest of the world, with our Department of Defense being individually and unilaterally the world’s single biggest emitter of carbon (beside the rest of our historical industrial emissions)? To address that externality, we’ll need to invest in nuclear and carbon sequestration research and development.

An important aside: Humans will never use less energy.

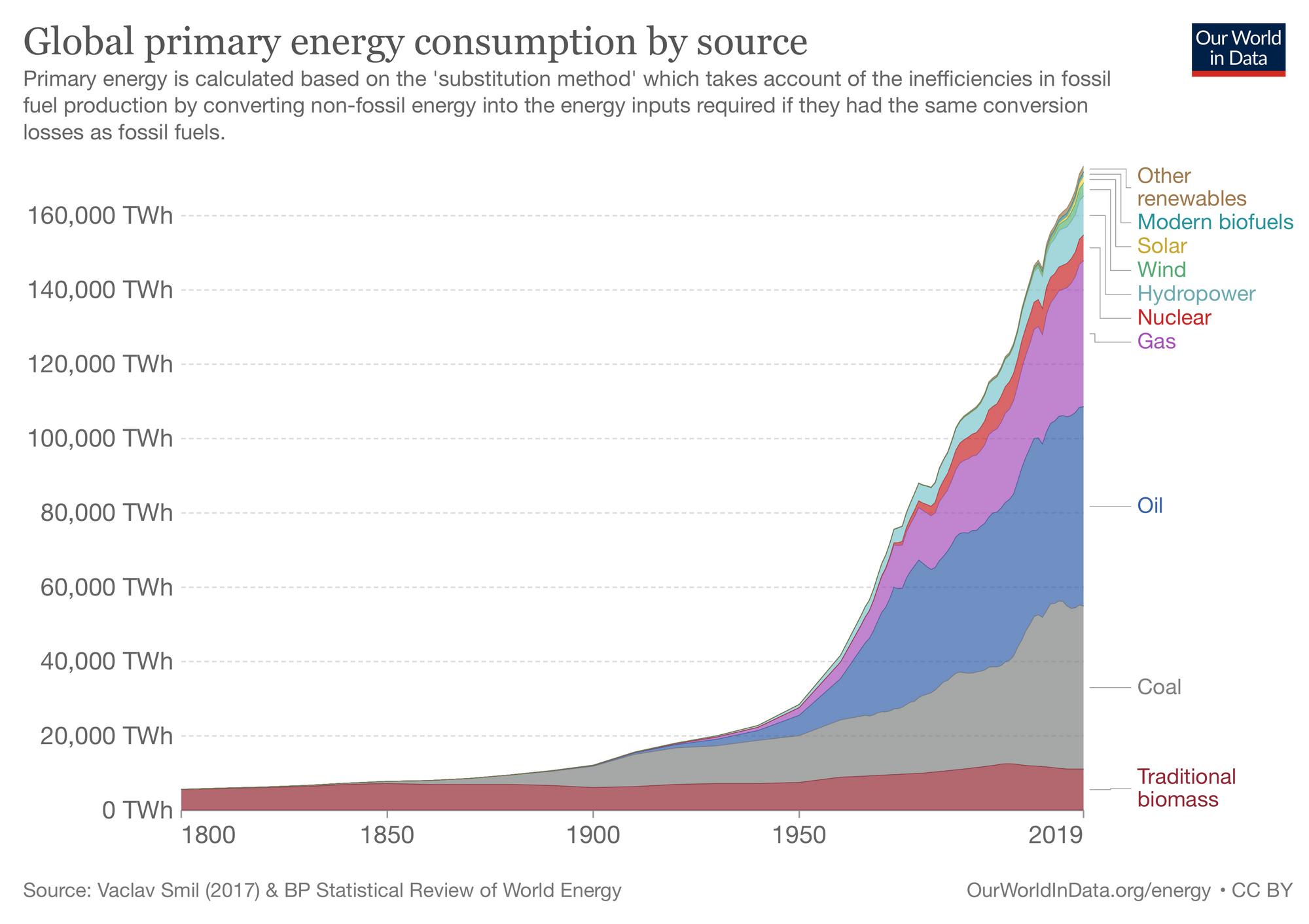

Anyone who talks about conserving energy as our hope for saving Earthhasn't paid attention to human or technology history. Humanity's appetite for energy has grown steadily and exponentially since the Industrial Revolution.

This trend is accelerating today: New breakthrough AI models require breathtaking, exponentially-increasing amounts of energy. Powering the brains of an autonomous car will require much more energy than your brain and body consume. Pulling carbon out of the air or salt out of water requires enormous amounts of clean power.

Energy usage has been a pretty good proxy for increasing standards of living, and exponential scaling laws suggest that future improvements in standards of living will require significantly greater amounts of energy.

We will continue to dream up new ways to use more energy until the end of our species. Mad Max tells the story of a future Earth where humans struggle to conserve what little energy’s left.

What could the future look like, in a post-sequestration era, with abundant energy powering breakthrough technologies and air cleaner than it is today? Energy abundance and Mad Max are competing alternate futures. It's hard to understand why Rosenthal chooses Mad Max.

Slide 3: El Salvador

An elected head of state ought to have more individual class and respect for their citizens than to tweet stupid things like this.

#NewProfilePic pic.twitter.com/YVDlBoA2Cq

— Nayib Bukele 🇸🇻 (@nayibbukele) January 22, 2022

He may not be a villian, but he's also no hero, and it is a mistake for the crypto community to uncritically treat him as one.

Similarly, and relevant to Americans is Arizona Senator Wendy Rogers.

Woke degenerate anti-American movies don’t make money. Traditional Christian America First movies do.

— Wendy Rogers (@WendyRogersAZ) February 12, 2022

We started with 41 https://t.co/GsDWXSp3fN

— Wendy Rogers (@WendyRogersAZ) February 10, 2022

This does not seem - to my not-psychiatrist-perspective - like an adult with all of their faculties about them. She isn’t our friend.

Slide 4: The “Transaction Rate” distraction

”Bitcoin is only processing around 27K "economically meaningful" transactions/day. And 75% of those are transactions between exchanges, so only 2.5% of the "transactions" are real blockchain-based transfers involving individuals. That's less than 5 per minute. “

Transaction capacity comes from Layer 2, not Layer 1. It is absolutely true that Bitcoin is a terrible choice for individuals to perform ordinary, daily transactions. It’s a shame (I guess) that Satoshi seemed to suggest he wanted it to be good for this use case. But anyway, here we are, and Bitcoin - for its warts - is a damn sight better than gold at the “scarce store of value” job.

Gold, slow as it is to move around (heavy, shiny, rock), still many digital-native derivatives (like ETFs). In a similar way, Layer 2 scaling technologies allow for greater transaction capacity (and complexity), taking advantage of the security and value guarantees of the underlying asset (e.g. Bitcoin).

It seems like a large omission to not acknowledge that greater than $1B of transactions happen per day on DeFi, using a variety of scaling solutions.

Slide 6: Resilience & Economies of Scale

Bitcoin rewards the most active participants in the network. Those with the most starting resources can afford to participate most, and thus reap outsized gains. Therefore, the rich get richer, and control is centralized.

It’s a fair criticism, as it goes, but it’s got nothing to do with crypto. It’s no different than how the our various societies have evolved over millennia. This compounding growth / consolidation of wealth and power is a function of all economic systems to date. It’s still early in crypto, though, and I’m hopeful that we will use crypto to unleash the varied creativity of many billion more humans, and share better a bigger pie.

Slide 7: Blockchain Patents

Rosenthal argues essentially, “The only reason to spend cold, hard, cash on mining is if you believe Bitcoin’s value will go up.” This seems like it should be true of any investment of resources you might make.

The “unsustainable carbon footprint” argument makes another appeance, without - of course - any rationale why his moral choices are the “right” ones or why reducing a small-country's worth of carbon and waste is a meaningful objective given the realities of energy use and emissions densities.

Slide 8: Bitcoin Energy Consumption

After some impressive mathematical gymnastics, Rosenthal declares that Bitcoin creates “an average of one whole MacBook Air of e-waste per ‘economically meaningful’ transaction.”

First, on the topic of e-waste: How much annual e-waste does the US DoD produce? How much e-waste does the US DoD burn in their gates-of-hell cancer-causing-burn-bits? How much e-waste (and carbon) do high-end video games requiring powerful GPUs create every year?

What exactly is “economically meaningful”? Well, as Rosenthal tells it, Bitcoin is awash in general malfeasance and shenanigans, and the net of that is - more or less - very few transactions are between individuals, and thus are mostly on exchanges, and therefore wasteful speculation at best and money-laundering-induced waste at worse.

Another - albeit, more charitable - view is that the kinds of design decisions you need to make a “financial” system secure while letting literally anyone anonymously connect their computer to it and jointly run the system can be very strange and very wasteful when compared to their predecessors.

Automobiles are a lot less energy-efficient than horses. Each breakthrough ML model (e.g. GPT-3) takes orders of magnitude more power to train than the one it replaces. Rosenthal's perception of waste and economic utility hasn't been updated for the ML wave kicked off by his former employer (Nvidia), and it's a strange omission.

Slide 9: Facebook and Google

Some applications cost more energy than others. Some cars, manufacturers, etc. emit more carbon than others to accomplish the same task. So what?

Slides 10-12: Energy ROI & Emissions

“The world cannot afford to waste a Netherlands’ worth of energy on speculation that could instead be deploying renewables,” claims Rosenthal.

We’ve already addressed everything here, but for completeness:

- conservation is folly. clean, abundant power is an existential need.

- there’s no basis for moral authority for an energy police.

- if one insists on arguing about the morality of energy, let’s remember that the US Department of Defense is individually and unilaterally the world’s single biggest emitter of carbon, and regardless of your political beliefs, hopefully we can agree that there’s at least a couple billion folks on earth who don’t value the same things as the US DoD.

Slide 13: Chia

A particular blockchain (in this case, Chia), failed. So did pets.com, but I think we’re mostly happy we persisted in building out the Internet. If there’s a deeper point Rosenthal’s trying to make, it seems like it might be, “I was really excited about this blockchain, but it failed, so now I’m cynical on all of them.”

Slide 14: Proof of Stake

Rosenthal uses Gini coefficients as a measure of inequality, and declares that Bitcoin exhibits a high degree of inequity. Interestingly, looking at his own data, it’s hard to see why Bitcoin is worse than Planet Earth’s own estimated Gini coefficient of 0.68.

As far as the rationality of staking assets in Proof of Stake systems, if investors believe the value of something will increase over time, they will choose to incur present-term costs for long-term reward. Misrepresenting this rational (though, certainly open to debate) perspective as just toddler-esque “number go up” logic is myopic and/or disingenuous.

Slides 15-18: Centralization Risks & Sybil resistance

Centralisation risk is a real issue, and Rosenthal provides a thorough walk through many of these risks.

Unfortunately, he concludes his reasonable discussion of those risks, with this piece of conjecture:

“Alas, it is unlikely that any alternative defense against Sybil attacks will be widely enough adopted to mitigate Proof-of-Work's carbon emissions.”

It sounds intriguing. I’d very much like to understand why he thinks this problem won’t be solved. It seems to me like lots of clever (and some well resourced) folks are at least tying to work on the problem. Does Rosenthal know something he’s not sharing? Unfortunately, he doesn’t explore the question much less give an answer, just this mic-drop conjecture.

Slide 19-22: Immutability

The legal system provides for the primacy of human judgment. Blockchains deterministically execute code with - by design - no appeal to human decision makers outside of the system. This is definitely net-new territory, and I think Rosenthal provides an excellent explanation of the manifold risks that come along with immutability. Left undiscussed, though, are ways to model and insure against these risks, and there’s plenty of smart people working on those problems.

Slide 23: Mining pools & Tether

Tether seems concerningly opaque. The crypto community is doing itself no favours by uncritically endorsing (or remaining silent) about this opacity.

Slide 24: Anonymity

It’s inevitable that strong cryptography (without back doors) would eventually make AML/KYC difficult. Whatever the consequences of that, that day has arrived. Weakening encryption merely conentrates the risk on the entities who perform surveillance. In the real world, the NSA has already lost offensive cyber-weapons to hackers, and NSO group is hacking diplomats and journalists. Whatever the risks of anonymity, the risks of weak encryption are worse; as unthinkably horrific as mutually assured nuclear destruction.

Slide 25: The Oncoming Ransomware Storm

Ransomware is a cancer, and crypto makes the ransom payment easier, it’s true. But the real problem with ransomware is the pervasively lax IT and infrastructure security we’ve got, that provides such a hospitable environment for the ransomware to take hold The way to stop ransomware is better security, not looking the other way (at the payment rails).

Slide 26: Conclusions

Rosenthal suggests that Ethereum must be a pretty lame “world computer” if single Raspberry Pi is 5000x more powerful. It’s a bizarre framing, akin to asking how many horsepower your smart-lock has. Here’s - I think - the comparison to be made: Ethereum uses its compute to secure a few hundred billion dollars in economic value. Where is a raspberry pi’s worth of compute doing a remotely comparable job?

“For $2.5M we got Nvidia to working silicon that was revolutionary in two different respects. Right now, there is way too much money.”

I agree. There’s a lot of head-scratching deals in crypto, but then also some genuinely exciting innovation on hard problems. Also, wasn’t 640k supposed to be good enough forever?

If you believe - as I do - that crypto is a defining technology / idea (like the Internet, or open source), then we’re in our infancy, and we know that we’ll have our own Pets.coms to live through, and that in the long run, it’ll be worth it because we’ll have better technology, more unleashed human creativity, and more human thriving, not simply because “number go up”.